Muscat: Average residential rents in Muscat dipped in the first quarter and are likely to fall further if the current economic conditions prevail, Cluttons’ Muscat Spring 2016 Property Market Outlook revealed.

“Average residential rents dipped by 5.9 per cent during the first quarter (Q1), leaving them 12.7 per cent below Q1 in 2015. The decline was led by the villa market, leaving average monthly villa rents at just over OMR1,004, which is 14.1 per cent lower than Q1 of 2015. Wide ranging redundancy programmes in key sectors, with the oil and gas sector still shrinking, are having a direct impact on rental levels,” the report stated.

According to Faisal Durrani, the head of Research at Cluttons, if the expected bottoming out of the market does not in fact materialise, then demand for rental accommodation will continue to decline over the next six to 12 months, exerting further downward pressure on rents, particularly as core sectors, such as oil and gas, continue to show signs of shrinking.

**media[411159,411160,411161]**

“With this in mind, it is our expectation that rents during 2016 are likely to fall by a further 5 to 10 per cent, on average, across Muscat. However, it is worth highlighting that better quality properties priced at the lower end of the budget spectrum, at between OMR250 per month and OMR500 per month, are likely to remain stable,” Durrani added.

Philip Paul, Cluttons’ country head, Oman, said they continue to see increased vacancy levels in stock that is perceived to be secondary, presenting landlords with a significant opportunity to take a long term view and refurbish during this emerging void period.

Average rents

“With average rents slipping across Muscat, tenants are now benefitting from a choice, although Cluttons advises that good quality property that is correctly priced is still being snapped up quickly. Tenants are focused on good quality accommodation, with well managed facilities and amenities. With that in mind, upgrading stock is certainly advantageous for landlords at this time,” Paul said.

He added that in the sales market, Cluttons has recorded price declines across the board, with buyers now watching for affordable options as the market adjusts to the new market reality.

Cluttons’ research further revealed that during the first quarter of 2016, transactional volumes across the Sultanate were slightly lower than in the same period in 2015, according to the National Centre for Statistics and Information (NCSI).

**media[411160,411161]**

The figures showed that the traded value of property during this period decreased from OMR1.322 billion in Q1 of 2015 to OMR0.922 billion in Q1 this year.

“This decline reflects the squeeze on disposable household incomes across the region as the era of low oil prices beds in. Going forward, we expect this trend to persist, particularly as oil prices appear unlikely to stage a comeback in the near term. With the region’s governments rushing to diversify income streams through the introduction of new fees and taxes and the dismantling of energy subsidies, household incomes in the GCC (Gulf Cooperation Council) are expected to come under further pressure, with disposable incomes also likely to fall and Oman has not been immune to this,” Paul added.

**media[411161]**

According to Cluttons, rents across most of Muscat’s main office markets have remained steady for the ninth consecutive quarter, despite strong headwinds for economic growth.

The only sub-market that has shown movement in rents in the past one year is Shatti Al Qurum, where office rents have risen by 6 per cent to OMR8.50 per square metre (psm).

Durrani said they are aware of instances where landlords have used the recent increase in the lease registration fee from 3 per cent to 5 per cent as a way to support asking for rents in the first year of tenancies; however going forward we expect to see significant concessions made in order to attract and more importantly, retain existing tenants.

“With this in mind, it is our view that average monthly rents, which roughly hover between OMR4 and OMR9 psm per month, are likely to decline by OMR1 to OMR2 psm across the board over the course of the year as the market adjusts to the challenging economic environment,” Durrani stated.

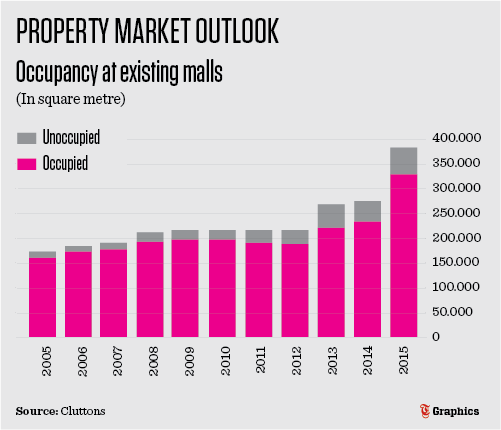

The report also highlighted that after limited growth between 2005 and 2012 in the retail market, recent years have seen the introduction of a significant amount of new retail mall space in Muscat, which has increased the supply of leasable space by approximately 75 per cent over the last three years alone.

The most notable malls introduced during this period are the Muscat Grand Mall, the Avenues Mall and the Panorama Mall, which are all located in Bausher.

Despite the marked increase in retail mall space, occupancy levels have remained relatively stable at around 85 to 90 per cent.