Muscat: Investcorp, a leading global provider and manager of alternative investment products, on Monday announced that it acquired 11 new US multi-family properties. The portfolio totals 2,615 units for a combined purchase price of approximately $370 million. The acquisition marks Investcorp’s largest US real estate portfolio acquisition completed in the past decade.

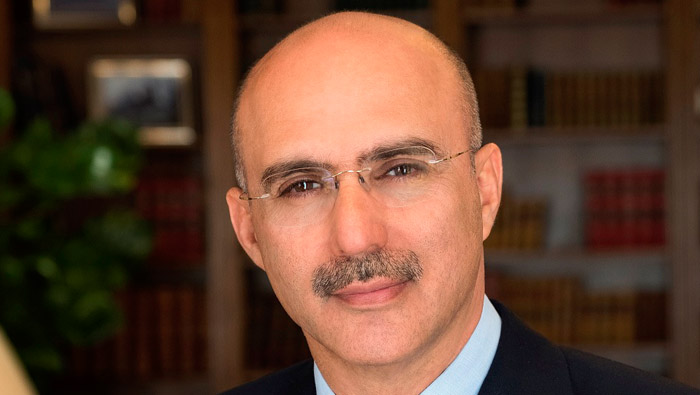

“This diversified acquisition marks a very exciting milestone for our real estate investment team as this is the largest real estate portfolio we have acquired in the US market in more than 10 years,” said Mohammed Alardhi, Executive Chairman of Investcorp.

“As one of the most active investors in US multifamily real estate, our real estate investment business continues to be an important driver of our ambitious long-term global growth strategy on the path to $50 billion in AUM,” he added.

The 11 properties in this portfolio are located in major US metro areas in which Investcorp made previous acquisitions. The properties are located in six major metro areas across five states including Orlando, Florida; Tampa, Florida; Raleigh, North Carolina; Atlanta, Georgia; Philadelphia, Pennsylvania; and, St. Louis, Missouri.

Investcorp has partnered with an affiliate of Equus Capital Partners, Ltd., a Philadelphia-based vertically integrated real estate fund operator, in this transaction. Equus’ management affiliate, Madison Apartment Group, will also serve as the on-site property manager for the portfolio.

“We continue to see significant investment opportunities in US multi-family given it is a well-performing, highly liquid asset class that draws upon the current strength of the overall US economy and labour market,” said Michael Moriarty, Principal in Real Estate Investment at Investcorp.

“Similar to many of our other recent multifamily investments, the assets in this portfolio are appealing because they are located in metro areas that are either key growth markets or population dense areas with new supply constraints. Each property offers strong existing occupancy levels and we believe also offers the opportunity for value-add renovations.”

Over the last 12 months, Investcorp ranks as a top-10 buyer of US multifamily units according to Real Capital Analytics, having acquired approximately 7,700 units. Since 1996, Investcorp has acquired more than 600 total properties with a combined value of more than $16 billion.