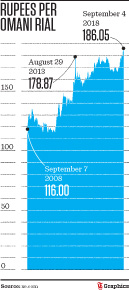

Muscat: With one Omani rial now worth more than Rs.185, Indian expats in the Sultanate are now able to remit more money home than they did in the past.

Some 10 years ago, the exchange rate was some Rs.115.87 for a rial, which means that the remittance potential has shot up by 60 per cent in that time, even if salaries have stayed the same for some people. One rial is now worth Rs.186.05, and PK Subudhi, the general manager for Mustafa Sultan Exchange, said although this was good for expats in Oman, it would have consequences in the long-run.

“Obviously, if you are an expat living in Oman and you are sending money back to India, it is a good thing because you can remit more money home, but in the long term, it is a bad thing, because inflation will increase,” he said. “That means that if you are sending money back home to your family in India, it will be more expensive for them to buy things.”

“It’s not just the Indian rupee that is falling this way, though,” added Subudhi. “A lot of the developing countries have this problem at the moment. Argentina, Turkey, the Philippines and Indonesia are among the most hard-hit nations. Even the Chinese yuan is not safe right now, so it is not just the Indian rupee that is affected. Because there is so much global economic uncertainty, the currencies of many emerging economies are suffering.”

Subudhi added that the opening up of the Indian economy meant the currency was more open to global fluctuations.

“Earlier, the Indian market was not so open, so the rupee was insulated,” he explained. “Now, the market is open and the economy picked up and became stronger but it also meant the rupee was more vulnerable, because it was more dependent on external conditions. Also, India is an importer of oil and it imports many other consumer goods as well, so there is a current account deficit in the nation’s spending power.”

“The price of oil is around US$75 a barrel so that is really hurting the economy,” added Subudhi. “For the Indian rupee to be stronger, it needs to import less items, or export more things, and the price of Brent Crude oil needs to be around $65 a barrel. If the oil price continues to increase, it could mean that the rupee will continue to slide. In that case, the GDP growth rate of 8.2 per cent that India has forecast may not happen and might need to be revised.”

In addition, R Madhusoodanan, general manager of Global Money Exchange, said that although some people might wait to remit money back home as they waited for the rupee to decline even further, it could pick up in the future.

“I might ask people who are sending their money home to hold it,” he added. “But tomorrow if it rises, then they will come to me and say I made a mistake. I am not sure why only the rupee is being discussed. Other currencies have also corrected themselves, but the fall in the Indian rupee has been slightly faster than other currencies in the emerging economic countries. Beyond this level, however, it is a cause for concern.”

“If you see the way the rupee has been falling, one dollar was first some Rs.70, so people sent the money they had here back home,” Madhusoodanan explained. “Tomorrow, it may reach Rs.72, and people who sent money earlier will say they were fooled; so what is the best time to send money? There is no proper answer to this question.”

Dr CK Anchan, an international investments and trade advisor, said that the decline also took place because as demand for the dollar grew due to global uncertainty, other currencies had to revise their exchange rates.

“The rupee is the second-biggest loser in the BRICS group: Brazil, Russia, India, China, and South Africa,” he said. “The Russian rouble is the only currency that has lost more value than the rupee in 2018 so far. The fall in the Indian rupee can be attributed to higher crude oil prices, widening trade deficit, and higher capital outflows; India spends more money on importing crude oil above anything else. Nearly 80 per cent of the country’s fuel needs are met by imported crude oil. The daily fuel demand is expected to more than double to 190,000 barrels in 2018, up from last year’s 93,000 barrels.”

“The rupee has been depreciating for quite some time now because of trade deficit and a higher current account deficit,” added Anchan. “China is India’s largest trading partner and in 2017-18, the total trade between the countries amounted to $89 billion. The US comes second in the order, with a total trade value of $74 billion. But India’s exports to China are lower than what China imports from India. So this trade is very favourable to China. In the case of the US, India runs a trade surplus.”