Almost lost in the tragicomic presidential election is the deep and growing antipathy toward Big Business. It comes through in the candidates' rhetoric, voters' behaviour and the issues driving the campaigns.

The anti-corporate sentiment is so strong that normally passive business leaders are finally pushing back. Two chief executive officers, General Electric's Jeffrey Immelt and Pfizer's Ian Read, wrote op-eds on Thursday complaining of the anti-business atmospherics.

Business' Washington agenda -- corporate tax reform, approval of the Trans-Pacific Partnership trade treaty, regulatory relief, immigration liberalization, more public-works spending -- is shot. That's not unusual in a presidential election year. Yet this season's anti-corporate mindset seems fiercer than in the past, and likely to continue under a new president and a new Congress.

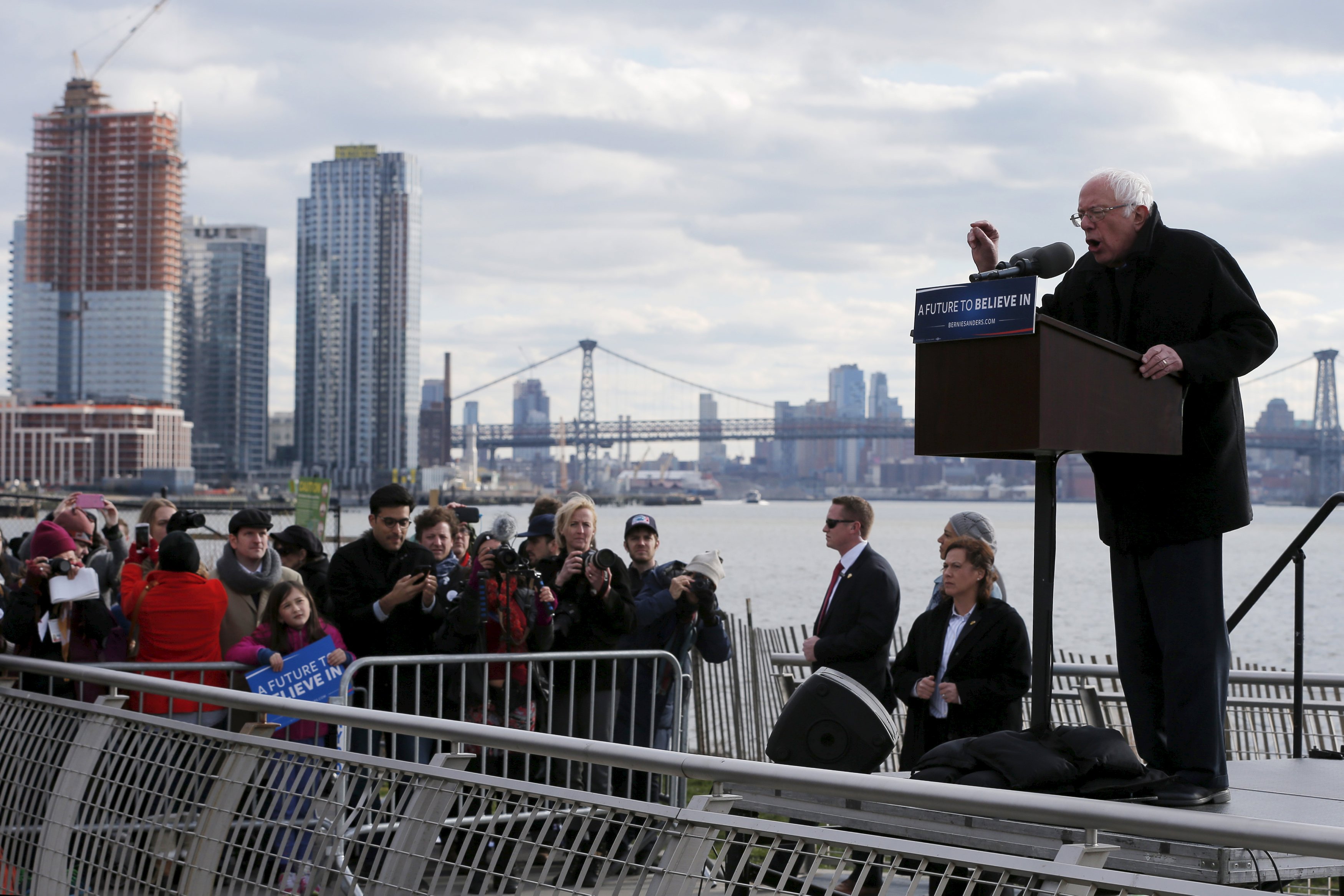

Voters are showing disdain in many ways. The candidates on which business leaders showered the biggest campaign contributions -- Jeb Bush, Chris Christie, Marco Rubio and Scott Walker -- achieved little traction in polls and primaries. The candidate that business dislikes the most, Bernie Sanders, has done remarkably well.

The most obvious example of the anti-corporate vibe is Donald Trump, the billionaire businessman who regularly demonises companies for hiring immigrants and moving production overseas (both of which he has done). Sanders has won seven of the last eight Democratic contests by calling for bank breakups, higher corporate taxes, expensive jobs programmes and repeal of trade deals.

Even Hillary Clinton, who historically had been business-friendly, tries to out-Bernie Bernie by proposing tough new measures to regulate Wall Street, opposing a new free-trade deal and offering new social-welfare programs to be paid for with higher taxes.

The dissatisfaction in part grows out of the recent recession. Congress passed the 2010 Dodd-Frank financial reform law to address abuses in the banking industry that caused a tsunami of mortgage defaults, a frozen credit system and, ultimately, millions of job losses.

Though the recession ended more than six years ago, the effects linger. Incomes remain stagnant, economic growth is anemic and upward mobility is stalled. When presidential candidates want to tap the well of worker anxiety, they often blame Obama, and then rapacious companies.

The dislike of Big Business, though, predates the recession. The anti-free-trade movement runs deep because successive presidents failed to address the job displacement that trade deals cause. They didn't see that technology and globalisation forces were also taking a toll on the middle class.

The Tea Party has played a part, too. It champions small business, but holds no truck with large corporations or the financial industry. Business-backed lawmakers have been in retreat since the 2009 emergence of the Tea Party, which has helped depose such prominent pro-business Republicans as House Speaker John Boehner and his No. 2, Eric Cantor. The US Export-Import Bank's authority was allowed to expire for six months last year because Tea Party-backed lawmakers saw it as corporate welfare.

To some longtime observers of the ups and downs of business's reputation, this time seems different. Jeffrey Garten, the Yale School of Management's dean emeritus, said in an e-mail that business has gone through similar waves of unpopularity, including in the 1970s when Idaho Democratic Senator Frank Church held hearings that put multinational corporations in a harsh light (and resulted in the Foreign Corrupt Practices Act).

It happened again in the early 2000s, when Enron's collapse revealed the failure of auditors, counselors, regulators, boards and other corporate gatekeepers to protect shareholders, consumers and taxpayers (and resulted in the Sarbanes-Oxley reforms).

But Garten, who was Undersecretary of Commerce for International Trade under Bill Clinton, said he can't recall "the basic framework of capitalism being so challenged." Companies now "are seeing pressures of a more existential nature," in which critics "question the benefits that US companies derive by their global activities."

Nowhere is this more obvious than in discussions of trade and immigration. Between them, Trump and Sanders have collapsed the bipartisan consensus in favor of free trade and shut down the possibility of a congressional deal to allow 11 million undocumented immigrants to remain in the US.

To voters from each party, trade and immigration have undermined, rather than improved, their economic chances. They see wealth flowing upward to business leaders and downward to immigrants, but not to households in the middle.

No trade group has worked harder to keep the Senate in Republican hands than the US Chamber of Commerce. And no interests do more to fund the Republican Party's activities than those of big business and Wall Street. But their wish lists of issues clash with the beliefs of many Republican voters.

The Democratic Party, meanwhile, is moving to the left as it attracts a younger, more racially diverse demographic that seems to have a dislike for Big Business in its DNA.

All of this means business leaders must rethink their approach to politics. And possibly prepare for a battle royal in coming years if pressures continue to grow for redistributive taxes that whack corporate profits. - Bloomberg View