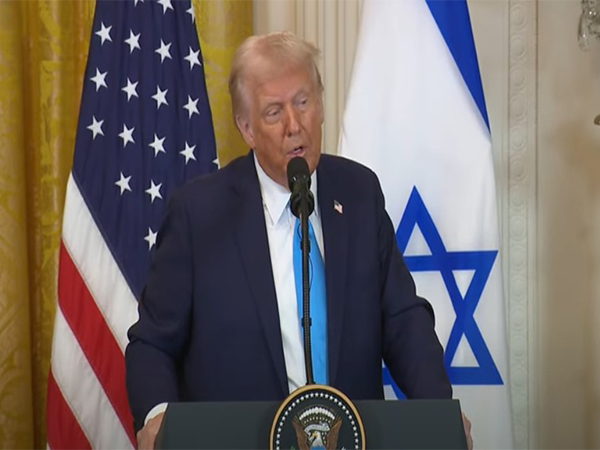

New York: US President Donald Trump has claimed that Hungarian-American billionaire George Soros’ organisations received $260 million from the US Agency for International Development (USAID) to influence political affairs and destabilise multiple nations, including India and Bangladesh.

In a post on X (formerly Twitter), Trump alleged, “George Soros received $260,000,000.00 from USAID and used this money to spread chaos, change governments and personal gain in Sri Lanka, Bangladesh, Ukraine, Syria, Iran, Pakistan, India, UK, and the US.” His remarks add to the growing scrutiny of US foreign aid, particularly as Trump’s administration has frozen USAID’s budget.

Reports indicate that over the past 15 years, USAID granted more than $270 million to organisations affiliated with Soros. One such organisation, the East-West Management Institute, partnered with Soros’ Open Society Foundations and received USAID funding. The revelation has fueled concerns over the US government’s role in international political movements.

Elon Musk, the head of DOGE, has supported Trump’s administration in highlighting USAID’s financial backing of what they call “woke and controversial” projects. Musk’s involvement has further amplified Republican criticisms of foreign aid being used for regime change and political influence.

In India, the ruling Bharatiya Janata Party (BJP) has long accused Soros of backing opposition groups and funding critics of Prime Minister Narendra Modi. BJP leaders claim Soros’ initiatives aim to destabilise the Indian government and interfere in national politics.