Muscat: The Indian expatriate community had mixed reactions to the first budget presented by the Narendra Modi-led government on Tuesday.

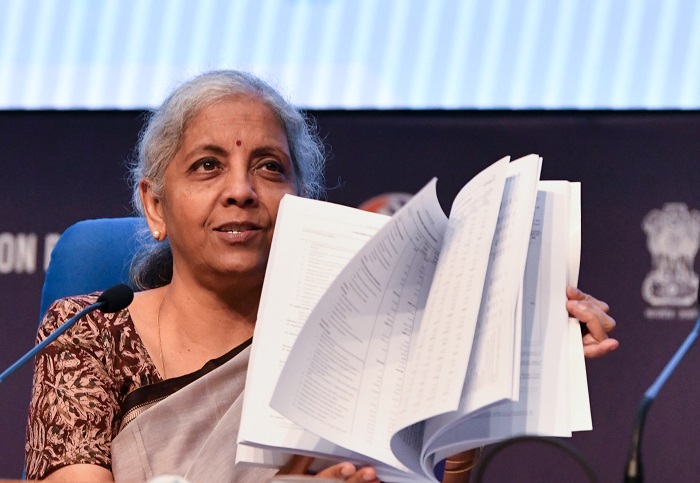

While many believed that the budget failed to address long-standing sops for NRIs, there were provisions related to employment, consumption boosts, and support for rural and MSME sectors that could invigorate NRI businessmen. The budget, presented by Finance Minister Nirmala Sitharaman, has sparked varied opinions among NRIs.

R. Madhusoodanan, a financial expert based in Muscat, expressed disappointment in his remarks to the Times of Oman.

“The Indian expat community had high hopes from the new government, expecting substantial reforms and measures addressing their unique concerns. With Indian diaspora remittances reaching over INR one lakh crores (US$1.25 billion) last year—the highest in the world—expectations were justifiably high. Among the key demands were comprehensive social security measures and rationalisation of exorbitant airfares. However, the Union Budget left many NRIs somewhat disappointed.”

Madhusoodanan, a former State Bank of India official, acknowledged the budget’s pro-development agenda within India, focusing on crucial areas such as agriculture, employment generation, youth development, and both urban and rural development.

“The agricultural sector, considered the backbone of India’s economy, stands to benefit from several new measures aimed at boosting productivity and sustainability,” he said.

He welcomed the reduction in customs duties on gold, silver, platinum, and mobile phones.

“The reduction in customs duties is a welcome step and has been warmly received by both industry leaders and the general public, in particular, NRIs. Given that a significant portion of India’s forex is used for importing oil, gold, and electronic items, this move could lead to increased imports, potentially impacting the balance of trade,” Madhusoodanan explained.

He also noted the “abolition of the Angel Tax” as a significant win for startups and entrepreneurs and mentioned that a 5% reduction in corporate tax for foreign companies is expected to attract higher investments into the country.

He said: “The budget did offer some respite for the salaried class and pensioners with enhanced exemptions on personal income tax. However, others will have to contend with rate adjustments in the tax slabs, with no relief for those sticking to the old tax regime. The basic exemption limits for both old and new regimes remain unchanged. “The stock market reacted negatively to the budget, primarily due to the upward revision in the Securities Transaction Tax (STT) and changes in short-term and long-term capital gains taxes. The Indian rupee has also depreciated against the dollar, indicating that the markets may take some time to stabilize as they absorb these new developments,” he added.

Piyush Jain, Group CFO of Al Tasnim Enterprises LLC, also shared his thoughts with the Times of Oman. “The first budget of the Modi 3.0 government sent a strong message on employment and skilling, consumption boost, and support for rural and MSME sectors. Digitalisation and fiscal controls remain the focus as well.”

He highlighted two perspectives for the NRI community regarding the budget.

“For NRI businessmen and large NRI-owned companies, the budget is likely to boost overall investment in India and open up more opportunities in MSME, agriculture, and skills development sectors. NRI businessmen should explore synergies in these focused sectors to fuel growth by investing in these specific areas apart from manufacturing, automobile, semiconductors, EV, and defence sectors,” Jain said.

However, for the workforce and salaried-class NRIs, the budget has “not brought any major good news as it proposes higher taxes on certain capital gains for non-residents, such as listed equities. Long-term capital gains (LTCG) have increased to 12.5% from 10%, and short-term capital gains (STCG) to 20% from 15%,” he noted. “Additionally, the withdrawal of indexation benefits for properties may have huge tax implications upon selling them, although the overall tax rate has been reduced from 20% to 12.5%. The INR 1.25 lakh LTCG non-taxable ceiling has been raised from INR 1 lakh, giving some breather to taxpayers,” he said.

P. Samir, another NRI based in Sohar, welcomed the budget’s focus on job creation and skill development programmes for millions of youth. “These measures are designed to maintain fiscal discipline while encouraging digital and infrastructural growth. We welcome the new budget’s focus on manufacturing capacity,” Samir said.

He also welcomed the reduction in gold duty from 15 percent to 6 percent, calling it positive news for NRI families. “Reduction of duties on mobile phones, chargers, and silver will stimulate consumer demand and benefit domestic manufacturers by reducing input costs,” he added.