Muscat: Bank Muscat Money Market Fund, Oman’s first money market fund, registered a strong performance with net annual returns of 5.20% realized for investors by the end of February 2024. With Assets Under Management (AUM) at over OMR91 million at the end of February 2024, the Fund retains its top position as the largest open-ended mutual fund in Oman. The superior performance and growth in the Fund’s assets are also a recognition of the popularity of the Fund amongst investors.

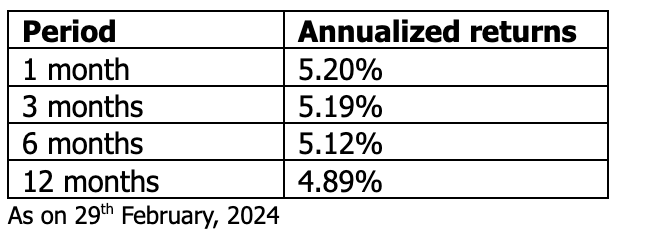

The fund offers an attractive cash management tool for investors to invest their short-term cash surpluses at an attractive return with relatively low risk (for details, please refer to the Prospectus Chapter 7: Risk factors and mitigation available on www.bankmuscat.com). The current annualized rate of return on the Fund exceeds 5% (as 29th February 2024), which is higher than the interest rates typically available on alternatives that provide short to medium term investment opportunity with relatively low risk. Accordingly, investors can benefit from higher returns on their cash surpluses by investing in the Bank Muscat Money Market Fund. The table below illustrates the rates of return realized from the Fund across different periods:

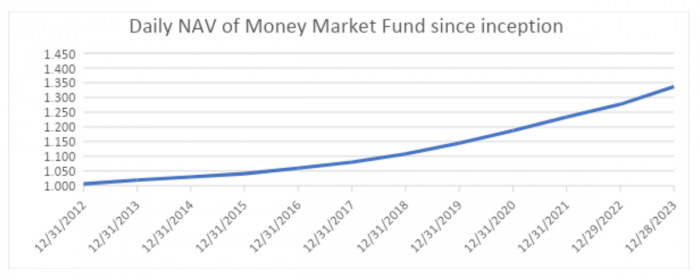

The Fund offers daily liquidity with one day minimum holding period, i.e., the investment period can be as short as one day. Further, investors have the flexibility to withdraw their investments, fully or partly, together with returns earned for each day of their investment in the Fund and the total proceeds of their investments would be credited in their bank account within two days from the date of submission of the redemption request. Investors can subscribe to the Fund with a minimum subscription amount as low as OMR 500 per transaction for both individuals and institutions investors. Further, the Fund does not charge any subscription or redemption fees and it has had a track record of consistent performance for more than 11 years. The chart below depicts the steady growth in the fund’s NAV since its inception in June 2012.

Bank Muscat Money Market Fund predominately invests in deposits and fixed-income instruments of leading financial institutions in Oman and GCC region and its investments are primarily held in Omani Rials or US Dollars. The Fund is regulated by the Capital Market Authority and is an open-ended fund with its Net Asset Value (NAV) being published on a daily basis on Bank Muscat’s website as well as Muscat Stock Exchange’s website, so that investors can track the value of their investments on a regular basis.

The Fund provides the added facility of convenient sweep-in and sweep-out from investors’ bank accounts with Bank Muscat. This enables investors to invest and redeem from the Fund in a simple way, through an email instruction to the Fund’s designated team. During 2023, the Fund was also made available on Bank Muscat’s Internet Banking and Mobile Banking (IBMB) platforms – another first in Oman, making it convenient for Bank Muscat’s customers to subscribe into and redeem out of the Fund by using their existing IBMB platforms. Alternatively, application forms can be downloaded from Bank Muscat’s website www.bankmuscat.com or can be obtained from the Fund’s Investor Servicing Desk which can be contacted at 24768064.

Bank Muscat’s Asset Management business has a proven track record of successful operations for almost 30 years and today the business is the largest asset manager in Oman and one of the leading asset managers in the GCC region, with approximately $2.9 billion of AUM. It offers tailored investment solutions across asset classes including equity, fixed income, real estate and private equity investments.

Please refer to the prospectus of Bank Muscat Money Market Fund available on www.bankmuscat.com to understand the Fund’s details including key terms and conditions. Investors are also requested to refer to the key risk factors highlighted in the prospectus. It should be noted that the mutual fund returns are subject to market performance and past performance doesn’t guarantee future performance.