Muscat: Bank Muscat, the leading financial services provider in the Sultanate and Suhail Bahwan Group Holding LLC, one of the largest diversified business and commercial groups in the GCC, headquartered in the Sultanate of Oman have signed a cooperation agreement to expand the bank’s cutting-edge digital solution coverage within the group, thereby accelerating digital transformation. Through this agreement, Bank Muscat will leverage its digital capabilities in providing industry proven innovative solutions of B2B Payments, Account Services, Collections & Receivables and Liquidity Management to Suhail Bahwan Group Holding for making their entire transaction process efficient, seamless, and secure. This agreement further enhances the existing relationship of Bank Muscat with Suhail Bahwan Group Holding, which includes wide range of banking solutions and services comprising of corporate loans, trade finance services, investments, and digital channel solutions.

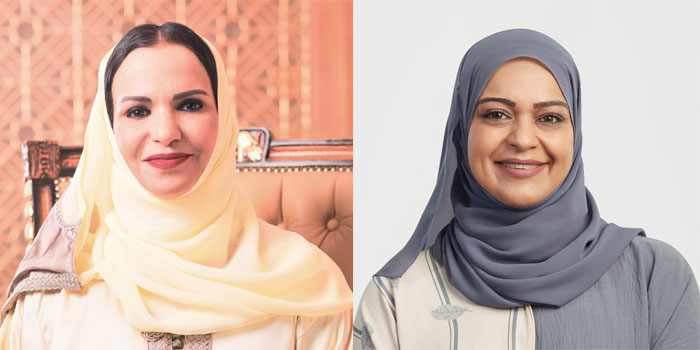

The agreement was signed by Amal Suhail Bahwan, Vice Chairperson, Suhail Bahwan Group Holding and Ilham Murtadha Al Hamaid, General Manager - Corporate Banking, Bank Muscat.

Speaking on the digital transformation, Ilham Murtadha Al Hamaid, General Manager-Corporate Banking, Bank Muscat, said: “We are currently in an exciting new era which is characterized with innovation, technology, and digitization. The digital transformation is very much essential for an organization to maximize execution capacity and for achieving breakthrough performance level. We are further strengthening our long-standing relationship with Suhail Bahwan Group Holding, with our new age digital solutions accelerating the digital and process transformation initiatives within the group. As a trusted banking partner, we are pursuing an ambitious digital transformation strategy to support the success of our customers. We are building on our expertise and understanding of transaction landscape to bring sophisticated digital solutions to our customers to enhance their banking convenience.

Amal Suhail Bahwan, Vice Chairperson, Suhail Bahwan Group Holding said: “The case for digital transformation has never been so clear. We are delighted to partner with Bank Muscat to drive business transformation within our group in all areas of banking, which includes payments, collections, visibility of funds and liquidity management. The digitalization will immensely benefit our customers, partners, and employees. The new digital initiatives will act as a catalyst in shaping our journey to become a future ready and sustainable organization. A shift to digital typically brings in a host of benefits including efficiency, cost reduction, accountability, speed and scalability to our group which enables us to stay ahead of the market change.”

Bank Muscat’s ‘B2B Connect’ platform is a Host-to-Host solution through which corporates can directly integrate with the Bank’s systems, and embed the banking solutions for salary and vendor payments within their ERP systems. The bank’s niche Business to Business (B2B) Connect platform is particularly useful for institutional customers as they can achieve a high degree of automation in payables reconciliation and minimise risks related to payment processes through the solution. The enhanced ease of banking will enable the institution to provide better service to its vendors, customers and other stakeholders because of the straight-through nature of online channels.

Bank Muscat’s Transaction Banking solution enables achievement of automation in the activities of the treasury/finance team through cutting-edge technology and processes aligned with corporate’s needs. The Account Services solution provides enhanced visualization of the overall banking relationship across all banks which includes accounts with Bank Muscat as well as other local/international banks. Direct Debit and Virtual Accounts are collection solutions, which facilitate automation in the reconciliation of receivables in addition to providing corporates with complete control and visibility of collections. ‘Sweeps’ is an advanced liquidity management solution for account balance management, which allows automation in funds movement between accounts as per pre-defined rules.

With business connectivity and digitalisation now more important than ever, Bank Muscat's corporate banking solutions are providing its valued clients with seamless access to a number of corporate services that is crucial to their success in the modern world. The bank’s corporate offerings include tailor-made solutions such as Corporate Internet Banking, Remote Cheque Deposit and Direct Debit solutions. Bank Muscat has been a pioneer in Oman in implementing digital banking solutions for its customers and is focused on helping corporates to make a smooth transition towards efficient tech-focused processes and use cutting-edge technology to their best advantage.

Please go to https://www.bankmuscat.com/en/business/Pages/Business-Home-page.aspx for more information on Corporate Banking solutions and services.