As part of its efforts to enhance customer experience by introducing shari’a-compliant offers, products and services, Alizz Islamic Bank has announced the launch of several finance offers on the occasion of the holy month of Ramadan.

These finance offers are available to all retail customers from the public sector, semi-governmental or private sector institutions who transfer their salaries to Alizz Islamic Bank or the bank’s customers who didn’t benefit from any previous finance facilities, with special finance rates on home finance, auto finance and personal finance, including Goods Murabaha & Service Ijarah.

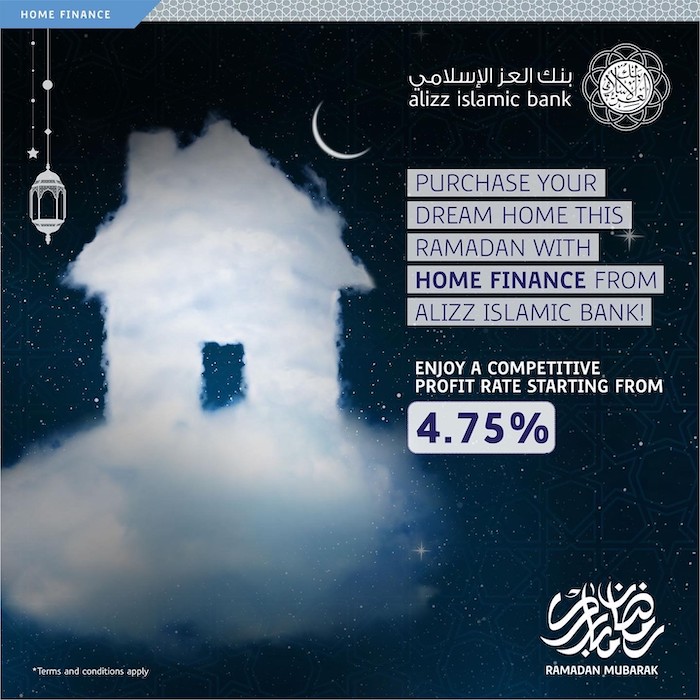

New customers can benefit from the home finance offer with a profit rate of 4.75% only for the purchase of ready properties and under construction properties, as well as Diminishing Musharaka to purchase lands. The new offer also includes auto finance at a competitive profit rate of 4.95% for terms of up to 5 years or 60 months only, and 5.65% only for terms between 6 to 10 years, i.e. +60 months to 120 months.

Moreover, Alizz Islamic Bank announced that its customers can enjoy the auto finance offer without the need to transfer their salary, which is applicable to all car finance schemes made on the basis of post-dated cheques, as the eligibility criteria for this finance option include the minimum salary, age, employer’s eligibility and debt burden ratio (DBR) as per the bank’s policy. This offer applies to auto finance only and is exclusive of the Murabaha finance product for land finance or commercial products.

Commenting on launch of these various offers, Mohammed Al Ghassani, Chief Consumer Banking Officer at Alizz Islamic Bank, said: “We give priority to enhancing the customer experience, and it is our tradition since the bank’s inception to launch various finance offers that meet needs of all segments of the society during the holy month of Ramadan. We are keen on taking customers’ requirements into consideration during the development of the offers, services and products that we launch from time to time. It should be noted that this campaign was preceded by a comprehensive training of our staff in all branches to ensure seamless experiences”.

Al Ghassani added: “We conduct surveys periodically, to assess customers’ satisfaction with our services and products, and to determine the offers they expect the bank to launch. We do not take a step forward until we are pretty sure that it will be for the customer’s benefit as we provide the appropriate offers that fulfill customers’ needs, whether with respect to personal finance, home finance, or even auto and land finance”.