Muscat: Bank Muscat, the flagship financial institution in the Sultanate, has announced its preliminary unaudited results for the year ended 31 December 2021.

The financial results are subject to external audit and approval of the Board of Directors, Central Bank of Oman and Shareholders of the bank.

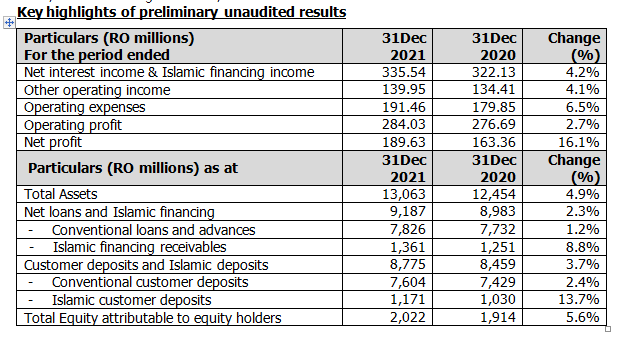

The bank posted a net profit of OMR189.63 million for the year compared to OMR163.36 million reported during the same period in 2020, an increase of 16.1 per cent, mainly due to higher operating income and lower impairment charges.

The key highlights of the results for the period are as follows:

Net interest income from conventional banking and net income from Islamic financing stood at OMR335.54 million for the year ended 31 December 2021 compared to OMR322.13 million for the same period in 2020, an increase of 4.2 per cent.

Non-interest income was OMR139.95 million for the year ended 31 December 2021 as compared to OMR134.41 million for the same period in 2020, an increase of 4.1 per cent.

Operating expenses for the year ended 31 December 2021 was OMR191.46 million as compared to OMR179.85 million for the same period in 2020, an increase of 6.5 per cent.

Net Impairment for credit and other losses for the year 2021 was OMR60.22 million as against OMR81.04 million for the same period in 2020. The decrease is mainly attributed to the precautionary and collective provisions created by the bank during the first half of 2020, due to the onset of the Covid-19 pandemic and the historic decline seen in global crude oil prices. The bank remains vigilant of the continuing stress in the macro-economic and business conditions and its potential impacts.

Net loans and advances including Islamic financing receivables increased by 2.3 per cent to OMR9,187 million as against OMR8,983 million as of 31 December 2020.

Customer deposits including Islamic customer deposits increased by 3.7 per cent to OMR8,775 million as against OMR8,459 million as of 31 December 2020.

The full results for the year ended 31 December 2021 along with the complete set of unaudited financial statements will be released following the approval of the Board of Directors of the Bank at its meeting scheduled later during January 2022.