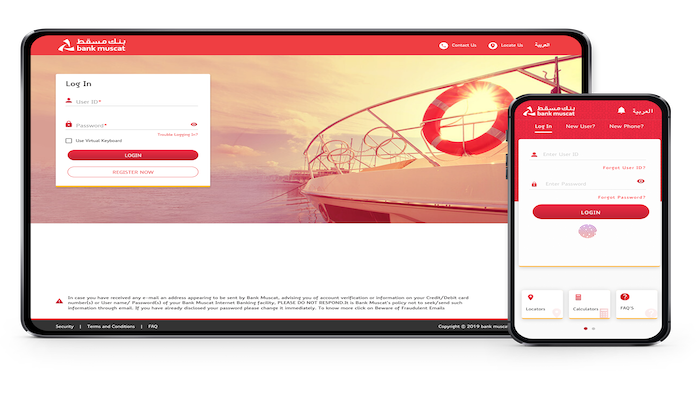

In line with its vision ‘To serve you better, everyday’ and commitment to customer service excellence, Bank Muscat, the leading financial services provider in the Sultanate, continues to provide as well as launch a number of secure digital banking services to its customers across the Sultanate. The bank’s online platforms meet the requirements of its tech-savvy customers and are further easing the delivery of various services. Various features available such as bill payments, mobile top ups, payments within Bank Muscat, within Oman and international payments and speed transfers to a number of countries including Bangladesh, India, Pakistan, Sri Lanka, the Philippines and Egypt are being used by large numbers of bank customers on a daily basis. It is important to note that Bank Muscat has been seeing a significant increase of active users on these platforms, especially in the post-pandemic phase.

The shift from traditional to digital banking remains an ongoing process with new features and services being continuously added for the benefit of customers. The biggest advantage of digital banking is that it gives people more ways than ever to access the services they need for their daily banking needs. It provides many tools and features that were not available in the traditional banking space.

Bank Muscat is particularly keen to encourage all its customers to use digital banking channels to meet their financial requirements and needs. Digitalisation of banking services and solutions is in line with the goals of Oman Vision 2040 and will greatly enhance financial inclusion in Oman. By investing millions of rials in the technological transformation of the sector and partnering with a number of leading experts, the bank’s customers are benefiting from the latest devices, solutions and technological advances.

Powering growth

Speaking about the transformation, Amjad Iqbal Al Lawati, Assistant General Manager - Cards and eBanking, Bank Muscat, said: “Banking across the globe is in a state of rapid change with the introduction of new digital services that greatly enhance banking convenience. As the leader in implementing innovative banking services and an enabler of financial transactions any time and from anywhere, Bank Muscat’s electronic services have been seeing a further rise in popularity during the post-pandemic phase.”

Today, customers can enjoy a fast and secure banking experience 24/7 from the comfort of their homes and offices. Already a large number of customers are using the various features available such as bill payments, mobile top ups, payments within Bank Muscat and Oman and international payments and transfers, QR code based PoS payments etc. They can make Speed Transfers to Bangladesh, India, Pakistan, Sri Lanka, Philippines and Egypt with instant credit to the beneficiary account in many cases, in addition to remittances to multiple countries through the SWIFT network. The bank’s customers find digital banking channels a convenient option to pay school fees, mobile top ups, transfer of funds within the bank and within Oman, change of PIN, loading funds on mobile wallet, and cheque book requests among others.

As the leading financial services provider in the Sultanate, Bank Muscat has the largest network in Oman with 174 branches and over 800 ATMs, CDMs and other devices. It is very heartening to see that the number of customers using digital banking services have skyrocketed, from less than 500,000 customers a couple of years back, to over 1.2 million customers today.

New e-services

The dynamic nature of the payments landscape is constantly opening up opportunities for innovation and growth. The growth of digital technologies has only accelerated new channels like e-commerce. Consumers are now more likely to make purchases using contactless cards, quick response (QR) codes, tapping their mobile phone or a wearable item (like a watch) onto a contactless payment terminal or reading a quick response (QR) code. The adoption of these new innovations has helped create new revenue channels and reduce overheads for corporates and governments around the world.

Bank Muscat has been spearheading this digital transformation in Oman by constantly launching new digital banking services. Recent updates include the availability of fast and secure QR code payments for customers using the Bank Muscat m-banking app and BM Wallet as well as facilitating the accepting of QR code payments by merchant partners; instant Debit Card linkage to customer accounts through Internet Banking / Mobile Banking, new Speed Transfer option to Egypt, online bill payments to Awasr; facility of viewing of Floosi and children’s accounts in their parent’s Internet Banking / Mobile Banking, instant generation of e-PINs for Debit, Credit and Pre-paid cards; opening of additional Savings Accounts for existing customers and the ability to block one’s prepaid cards in case they are lost or stolen.

The bank has also increased the limit of instant fund transfers to RO 5,000. Transfers are possible 24/7 within Oman through the Automated Clearing House (ACH) facility. Earlier in 2020, the bank also distributed new YouTube videos to demonstrate digital banking features including those available in the Mobile banking app. Links have also been provided within the app to make easy donations to charity and to apply for COVID-19 related deferments of loan repayments.

Largest network

As the leading financial services provider in the Sultanate, Bank Muscat has the largest banking network in the Sultanate with about 174 branches and more than 800 ATMs, cash deposit machines and multi-use devices distributed across the Sultanate. Today, the bank’s merchant partners across the Sultanate use over 24,000 Point of Sale (PoS) devices on a daily basis. The tremendous growth in PoS transactions is reflected by the fact that more than 61 million PoS transactions have already been carried out in 2021 compared to about 45 million in 2020. The technology-driven products and services are in tune with Oman’s move towards a cashless, e-payments-based society.

The Credit Card section too has also been recently upgraded and has additional features including getting Credit Card statements, viewing pending transactions and seeing details of the customer’s Easy Payment Plan (EPP). The customers can also view their prepaid card transactions and transfer funds to their prepaid cards instantly. The new system provides an easy way to make fund transfers within Bank Muscat by locating beneficiary accounts by using their mobile number.

Contact Centre services

The Bank Muscat Contact Centre represents an important channel of communication for the bank’s customers who are able to get in touch quickly with the bank whenever the need arises. As part of its customer-centric strategy, Bank Muscat operates the largest Contact Centre in the banking sector in the Sultanate, which is manned by a team of competent and highly trained Omani phone bankers. The Contact Centre uses an integrated voice response (IVR) system to respond to simple queries while phone bankers are always available 24/7 to handle more complex queries and clarifications.

It is a matter of pride that the Contact Centre, which receives millions of calls annually, has minimal waiting time with 90% of the calls being answered within 20 seconds. It is reachable at 24795555 via call or WhatsApp. The Contact Centre, which offers a number of banking services including fund transfers, utility bill payments, cheque book requests, real time deposit and exchange rates, has previously won the Best Industry Call Centre (Banking) at the prestigious Insights Middle East Call Centre Awards.

Awards and Accolades

Bank Muscat customer-centric vision and strategy of enhancing banking convenience has been well recognised locally and internationally with the bank winning numerous accolades and awards across its lines of business. Earlier in June 2021, Bank Muscat was recognised as one of the “Top 100 Companies in the Middle East” and also as one of the “Top 50 banks in the region” by Forbes Middle East. The bank has also won a number of awards from other prestigious international publications like Global Finance, Euromoney, The Banker and EMEA Finance.