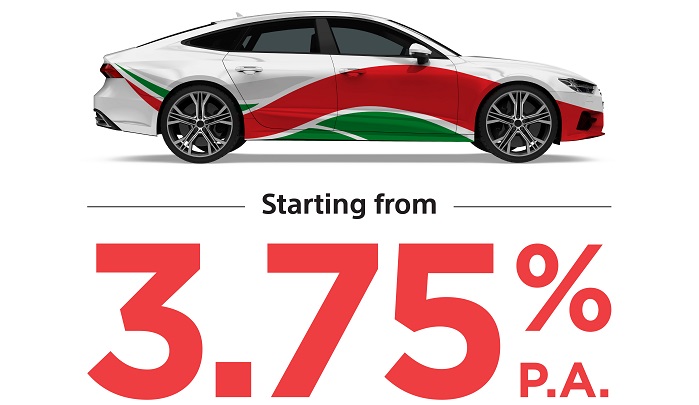

Muscat: The exclusive offer for “Sayyarati” Auto loan by Bank Muscat continues to attract attentions of customers wishing to purchase their dream car. The offer is only available for a limited period ending December 2023. It includes a discounted rate starting from 3.75% on new and pre-owned cars, waiver of fee on credit cards for the first year, and a free third-party motor insurance for used cars. Besides, Asalah priority Banking customers will have a further discounted rate starting from 4.75% for a maximum loan tenure of 60 months.

Omani nationals employed in government, quasi - government, Tier 1 companies will get a loan tenure up to 10 years, while those working in Tier 2 companies, will get a loan tenure up to 7 years. The offer also applies to expatriates working in government, quasi - government, Tier 1 companies who will get a tenure period up to 8 years. To make it easier for customers to take advantage of the benefits offered by financing products, they can now also apply through Internet and Mobile Banking.

On this special occasion, Abdullah Tamman Al Mashani, General Manager – Products, Bank Muscat, said: “Bank Muscat offers are designed to cater customers’ various needs. “sayyarati” is one of the popular financing products that always witness great turnout among customers for its exceptional and exclusive features on new and pre-owned vehicles. We are glad that this offer is well-received by customers who are benefiting from exclusive deals by auto agents and showrooms. Such offers reflect Bank Muscat’s keenness to provide unique products with new features and competitive interest rates on ongoing basis. I would like to thank all customers for their continued confidence in the services and products of the bank. I also urge every one to take advantage of this opportunity and enjoy a distinctive banking experience.”

With a fast turnaround time and absolutely no need for post-dated cheques, the feature-rich auto finance can be obtained within the shortest possible time through Mobile Banking or the Internet banking. The service is also available in Sayyarati Centres in Salalah and Wattayah as well as Bank Muscat branches located across Oman. Loans will be offered for both new and pre-owned cars. The documents needed to process the loan facility are minimal and include the buyer’s ID card, salary assignment letter, quotation / car valuation from the approved values, driving license, Mulkiya (for pre-owned cars only) and seller’s ID card (for pre-owned cars only). The Monthly loan installments for Sayyarati are automatically deducted from the customer’s account once the mandate to do so is provided to the bank by the customer. All customers wishing to own their dream car can take advantage of the fast transaction processing, as the transaction is completed within 24 hours, provided all the required documents are available.

As the leading financial institution in the Sultanate for the past four decades, Bank Muscat has the largest banking network in Oman with 178 branches, in addition to more than 820 ATMs, CDMs and multi-use machines, as well as Internet and Mobile Banking platforms offering round-the-clock banking services. For more information about the "Sayyarati" product, please visit the website through the following link: https://www.bankmuscat.com/en/loans/Pages/details.aspx#sayyarti.