Muscat: Motorists can expect to carry on paying more for petrol this year with no plans to cap the cost at the pumps if the global oil price continues to rise, a top official at the Majlis Al Shura economic panel said.

Get your essential daily briefing delivered direct to your email inbox with our e-newsletter

“At present there are no plans to cap the retail fuel prices in Oman. Even if the crude prices recover, the retail fuel prices will not be capped,” said Ahmed Al Haddabi, vice-chairman of Shura economic panel.

While the strengthening price of oil will help the Sultanate's finances it is also a double-edged sword for motorists now that the government has removed the petrol subsidy, letting the market dictate the cost at the pump.

April's price for Oman's commuters has increased.

Read here: Petrol and diesel to cost more in April

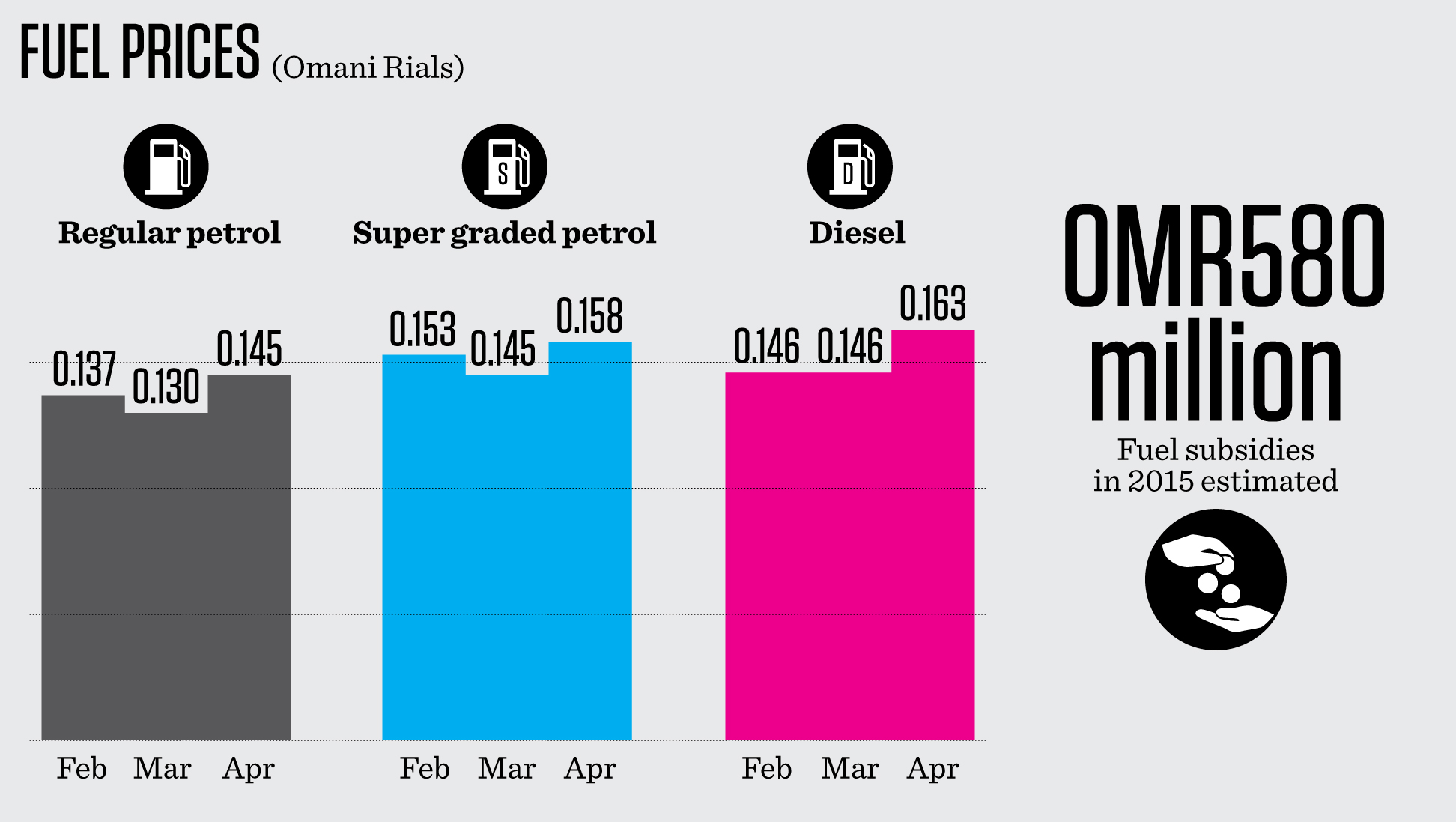

Citing a circular from the ministry of oil and gas, an official from one of the petrol and diesel distribution companies, said that in April, the revised regular petrol (M90) will cost 145 baisas per litre, super graded (M95) 158 baisas and diesel will cost 163 baisas.

**media[369467]**

In March, the cost of regular petrol (M90) was 130 baisas per litre, super graded (M95) was 145 baisas and diesel was 146 baisas.

Builders in Oman, who mainly depend on diesel, said that increase in fuel prices is a worrying trend and it is affecting their business.

Stay ahead of the rest and download our free WhatsNews app for Apple, Android or Blackberry

“The increase in fuel prices, especially diesel is affecting companies. It is adding more burden on their operational costs. Companies are preparing budgets foreseeing this. End products are becoming costlier,” Shahswar Al Balushi, the Chief Executive Officer of Oman Society of Contractors, said.

Before the end of the fuel subsidy on January 15 this year, the price of super unleaded petrol was 120 baisas; for regular it was 114 baisas and for diesel it was 146 baisas.

Another construction company official said companies are more cautious in taking up new projects.

“We agree that many factors are linked to construction sector ups and down. However, fuel price is a major one. Let it be a government project or a private one, all are cautious in taking up new projects when fuel prices are going up. Construction sector projects cannot be switched off suddenly at one day,” PP Ajayan, a top official at a Muscat-based construction company, said.

“If the suppliers in our sector increase the price citing diesel price hike, we will be hit badly. Transportation of materials is a vital factor in our sector,” the official said while adding that they don’t see a promising future.

Mohammed Al Khaldi, a geo-physicist at an oil firm in Oman, said that crude prices have been recovering for the last three months and it is expected that it may reach to $55 per barrel in the coming months.

“This means that retail fuel prices may go up again in Oman,” the geo-physicist, added.

A Muscat-based economist said that when the price goes up by more than 10 per cent it will affect oil dependent sectors.

“However, these companies have to adjust with new reality of market linked pricing. Over the medium term companies will decide how they will respond,” the economist said.

Meanwhile, Kabeer CV, a manager who runs vegetable distribution business, said that increase in prices of diesel is affecting them badly.

“I am transporting vegetables purchased from wholesale market in Mabelah and distribute at outlets in Mabelah industrial area. For hiring one delivery vehicle, per day I had to pay OMR20. I may have to shell out OMR5 extra now on,” Kabeer CV added.

Following the dip in global oil prices, Oman had deregulated its oil prices in January this year as part of austerity measures aimed at plugging the budget deficit.

Fuel subsidies for 2015 were estimated to be OMR580 million, and with deregulation the government will be able to save that money, which is expected to be a great help in reducing the deficit.