Muscat: A number of people have cancelled their rent contracts in 2017, according to statistics issued by the Muscat Municipality.

Cancelled rent contracts increased by 25.2 per cent, while there has been a 14.9 per cent decrease in permits given to construct major buildings in 2017, according to an annual report by the Muscat Municipality. Some 43,564 new rental contracts were registered with the municipality last year, a decline of seven per cent compared with the year before.

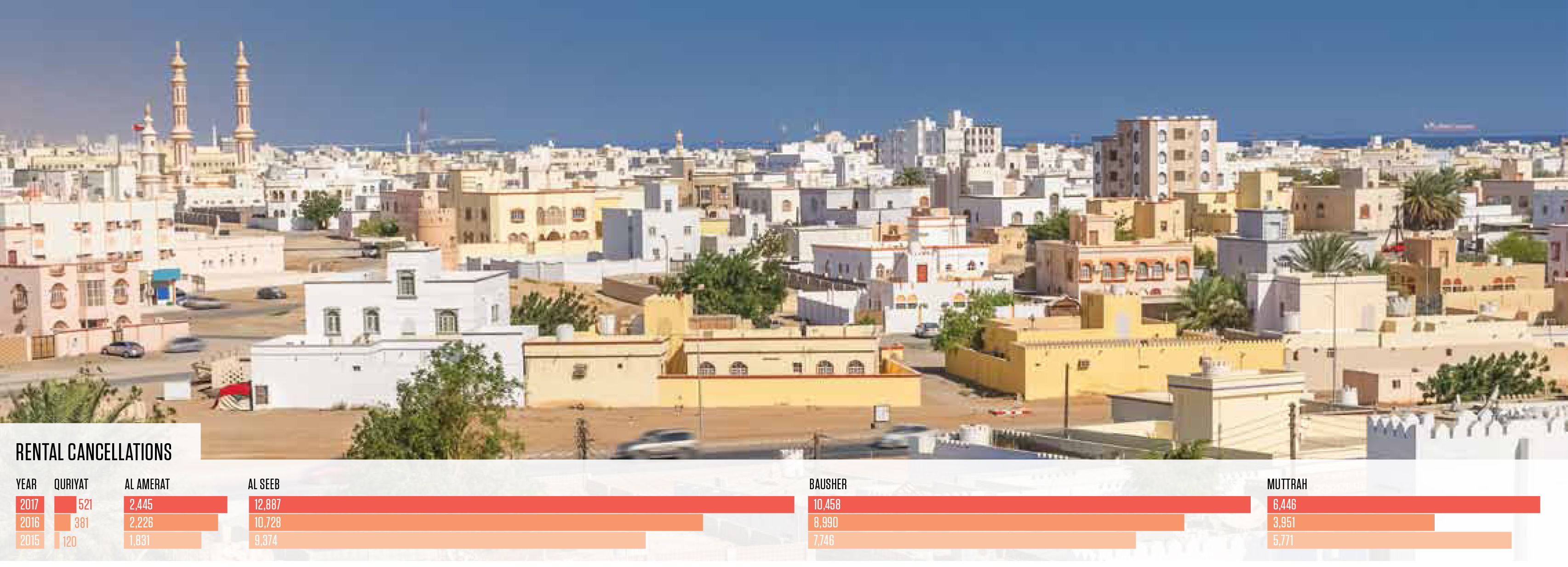

Among the contracts cancelled, Muttrah ranked first with a 63 per cent, followed by Quriyat at 37 per cent and Al Seeb at 20 per cent.

On the other hand, the rate of renewing contracts increased by 21 per cent in 2017 compared with 2016. Real estate experts also revealed that there has been an increase in vacancy rates and a sharp decline of 30 per cent in rents.

Less permits

In 2017, Muscat Municipality gave 443 permits to investors of major buildings such as residential and commercial buildings, which reflected a 14.9 per cent dip compared with the year before.

“Real estate Investments have been affected for many reasons, including an increase in fees by the Ministry of Housing, as well as the increase in price lists and taxes, in addition to the economic crisis,” said Hassan Al Ruqeishi, Head of the Real Estate Development Committee at the Oman Chamber of Commerce and Industry.

From 2015 to 2017, the rate of registered rent contracts that were cancelled increased by 31.8 per cent, the impact of which forced landlords and building operators to decrease their rents in order to attract more clients

“In the past few years, companies have laid off their employees or cancelled their housing allowances, and employees were forced to leave their homes, and the decline in the number of expats has clearly affected the rate of rent. As a result, rents in Muscat witnessed a 30 per cent decline,” explained Al Ruqeishi, who is also the owner of Al Ruqeishi Properties.

Al Khadouri from Al Sahwa Real Estate Company said, “Since 2014, the real estate market started to decline and therefore we lowered the rent prices of our apartments to attract customers.”

“In some apartments that we own, the rent has declined by 30 to 40 per cent; for example, rents that were OMR450 were cut down to OMR350, and then in 2018, we lowered the price again to OMR325,” Al Khadouri added.

Fahad Al Baloushi, a real estate investor, said: “The decline in rents differs from one area to another; for example, the rent of apartments in Al Mabela has decreased from OMR200 to OMR150, but some other places still retain their rent value because of high demand, especially areas such as Al Khoudh and Bausher.”

The number of expats in 2017 compared with 2016 has declined; as a result, many apartments have been left vacant.

Sudhakar Reddy, Chief Executive Officer of Al Habib company, discussed the vacancy rates in new buildings compared with old buildings saying, “Because of the high rate of vacancy in the last few years, we’ve had to decrease the rents. In old buildings, the vacancy rates are around 15 per cent in the entire building, while in new buildings, the rate of

vacancy is some five per cent.”

According to Al Ruqeishi, there are 250 offices and companies operating in the real estate sector in Muscat and most of them are faced with the issue of uncertain futures for their tenants.

“We have 120 vacant apartments, and there are many residential and commercial units that have been lying empty in recent years because of the economic downturn,” he said, adding, “I expect that the number of vacant units in Muscat alone exceed 100,000, including apartments, villas, and shops.”

Similarly, Al Khadouri added: “We have some 150 empty apartments. This is due to the movement of many expats, whether it is out of the Sultanate or to other governorates.”

Fahad Al Ismaili, Founder and CEO of Tibian Properties, said: “We have more than 1,500 real estate units under our management; we do have buildings with 100 per cent occupancy, and we also have some that are not fully occupied.”

Al Ismaili explained, “As a result of high supply, customers have more options now, and customers are moving from low-quality to higher quality buildings, which have more facilities and services that customers can get, so that they get more value for money.”