London: Berkshire Hathaway reported a sixfold jump in its first-quarter earnings, the New York Times reported.

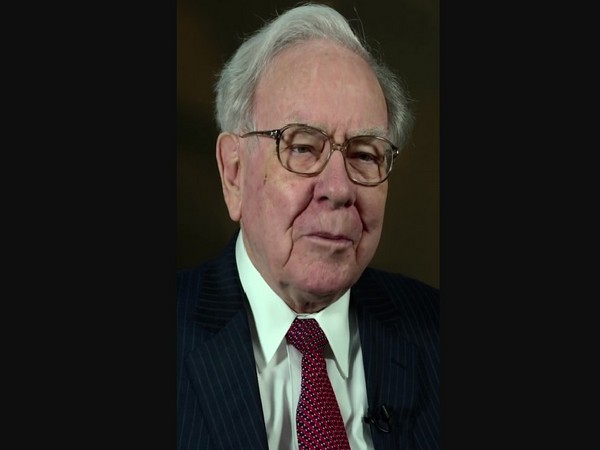

The daily newspaper said it was buoyed by huge paper gains on investments, as the conglomerate led by Warren E Buffett held its annual shareholder meeting in Omaha, its hometown. Berkshire, whose vast operations encompass insurance, railroads, utilities and consumer goods, said it earned USD 35.5 billion in the first three months of the year, up from nearly USD 5.6 billion in the same quarter a year ago, according to the earnings report revealed on Saturday.

With its breadth of businesses, the New York Times said Buffett's company is often regarded as a proxy of the American economy, and its results reflected some of the major trends of the moment, including the war in Ukraine, higher interest rates and fuel prices and a drop-off in consumer spending.

Powering Berkshire's jump in earnings was USD 31.1 billion in unrealised gains on the investments, the company makes using the flood of cash it collects from its insurance operations. That far outstripped the roughly 7 per cent gain in the S&P 500 stock index during the quarter, NYT said.

Other core parts of the Berkshire machine reported more mixed results.

Its insurance operations reported USD 911 million in net underwriting earnings, bolstered in particular by its Geico division, which benefited from higher policy premiums and fewer claims. It also reduced spending on its famed advertising campaigns.

Berkshire's mammoth BNSF railroad, one of the biggest freight networks in the nation, disclosed a slight drop in net earnings, to USD 1.2 billion. The company said that while the business benefited from charging higher fuel surcharges and rates per car, it was hit by rising fuel costs and lower shipments.

Its energy and power utilities division reported a sharp drop in net earnings, as higher operating costs offset an increase in revenues and customer usage.

The results on Saturday were published as tens of thousands of Berkshire shareholders descended on Omaha for the company's 59th annual meeting, in large part to hear directly from Buffett. Long known as the "Woodstock for capitalists," the hourslong event features Buffett and his long-time lieutenant, Charlie Munger, answering questions on a wide swath of topics, according to NYT.

This year's meeting is expected to carry extra weight for many shareholders. Given the ages of Berkshire's leaders -- Buffett turns 93 this summer and Munger is 99 -- it's unclear how many more meetings the two will chair.

That said, Buffett has laid out a plan of succession for his empire: His son Howard will become non-executive chairman, while Gregory Abel, a vice chairman who oversees much of Berkshire's non-insurance operations, would become chief executive, NYT said. Todd Combs and Ted Weschler, who have overseen parts of Berkshire's investment portfolio for years, would oversee all of it.