Washington: The US Federal Reserve for the third time approved an interest rate hike by 0.75 per cent in an aggressive move to tackle the inflation that has been affecting the US economy.

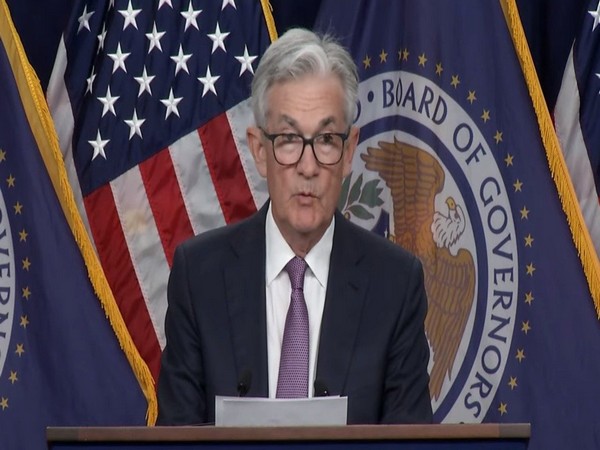

The hike takes the central bank's benchmark lending rate to a new target range of 3 per cent-3.25 per cent, which is the highest fed funds rate since the global financial crisis in 2008, reported CNN. "At today's meeting, Federal Open Market Committee raised its policy interest rate by 3/4 percentage points, bringing target range to 3-3.25 per cent," Jerome Powell, chair of US Federal Reserve said.

"We're moving our policy stance that will be sufficiently restrictive to return inflation to 2 per cent," he added.

This new hike will also likely cause economic pain for millions of American businesses and households by pushing up the cost of borrowing for things like homes, cars, and credit cards, as per reported by CNN.

Consumer inflation in the US declined marginally in August to 8.3 per cent from 8.5 per cent in July but is way above the 2 per cent goal. Several senior top bankers recently said that another interest rate hike is imminent. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby enabling the inflation rate to decline, according to US Economics at S&P Global Market Intelligence.

According to the official statement released by the Federal Reserves, the Russia-Ukraine war is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

"The Committee seeks to achieve maximum employment and inflation at 2 per cent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3 to 3-1/4 per cent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that was issued in May. The Committee is strongly committed to returning inflation to its 2 per cent objective," it added.

According to the statement, the Committee will continue to monitor the implications of incoming information for the economic outlook.

The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labour market conditions, inflation pressures and inflation expectations, and financial and international developments.