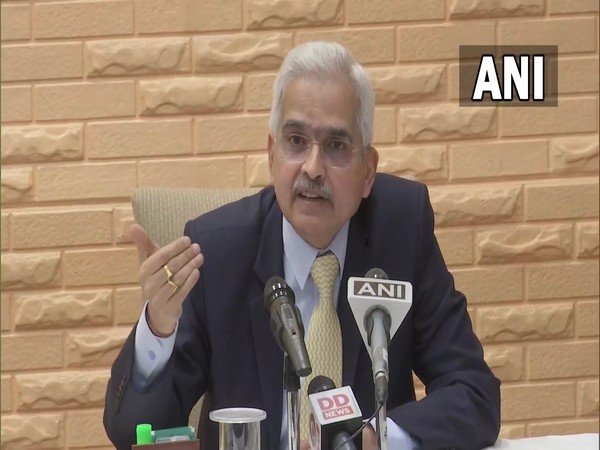

Mumbai: Businesses are facing multiple challenges posed by shocks such as the global financial crisis, COVID-19 pandemic, and now the war in Europe and the success of Indian entrepreneurs in the coming years will depend on how quickly and efficiently they are able to make necessary adjustments in their business models, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Thursday.

"If Indian businesses aspire to remain competitive and attain world-class status, it is important that they gear up to make the right investments sooner than later. I believe the pandemic-induced changes in strategy, management, operations and priorities are going to stay," Das said while addressing 'iconic week of Azadi ka Amrit Mahotsav' celebrations organised by the Central Board of Indirect Taxes and Customs in Mumbai. "Therefore, the success of Indian entrepreneurs will depend on how quickly and efficiently they are able to make necessary adjustments in their business models," he said.

Das said policy actions taken by the Government and the Reserve Bank since the onset of the pandemic in early 2020 have mitigated the disruptive effects of the pandemic while restoring market confidence and ensuring a quick revival in economic activity.

"Alongside, businesses are going through a redefining phase and are adapting to the new realities emerging from the pandemic," he added.

RBI Governor pointed out that the number of unicorns, or new businesses valued at over $1 billion, is rising very fast. These start-ups are supported by a new ecosystem of angel and venture funding, incubators and accelerators - as well as new patterns of consumption in society.

"A word of unsolicited advice to these young entrepreneurs and start-ups: they should constantly evaluate the build-up of risks and vulnerabilities in their businesses. I recognise that many of them may already be doing it and risk-taking is a part of their business model, but nonetheless, these are things which should always be kept at the back of one's mind for long term sustainability of any business," he said.

Das suggested that businesses should avoid having an aggressive short-term reward-seeking culture without considering the build-up of excessive risks in their balance sheets.

"Business models and business strategies of individual entities should be conscious choices, that are adopted following a robust strategic discussion in the Board, after considering all relevant aspects. Businesses should avoid aggressive short-term reward-seeking culture, without regard for the build-up of excessive risks in the balance sheet," he said.

RBI Governor noted that the common characteristics of some inappropriate business models or strategies that are observed include, inappropriate funding structure; building asset-liability mismatches which are highly risky and not sustainable; unrealistic strategic assumptions, particularly excessive optimism about capabilities, growth opportunities and market trends which may lead to poor strategic decisions that imperil business model viability; and over-focus on business considerations with neglect of risk, control and compliance systems.