New Delhi: Amid inflationary pressure in the economy, the Reserve Bank of India is likely to raise the policy repo rate by 40 basis points next week and hike it further by 0.35 per cent in August taking it to the pre-pandemic level of 5.15 per cent, according to economists and financial market analysts.

Last month, in its off-cycle monetary policy review the central bank hiked the policy repo rate by 40 basis points or 0.40 per cent. This was the first increase in the policy repo rate in nearly two years. The repo rate is the interest rate at which the RBI lends short-term funds to banks.

"The off-cycle rate hike has stoked expectations of front loading of rate hike decisions by RBI. With the US not yet relenting on moderating pace and quantum of rate hikes, and inflation not showing immediate signs of abating, it seems yet another slam dunk decision to hike rates in the upcoming policy," said Lakshmi Iyer,

Chief Investment Officer (Debt) & Head Products, Kotak Mahindra Asset Management Company.

On the quantum of the rate hike, Iyer said it would be in the range of 40 to 50 basis points.

"Quantum of the rate hike, 40-50 basis points in our view, will be a key determinant in extrapolating the terminal repo rate for FY 2023. Though aggressive tightening is already discounted by the bond markets, the stance of the policy will continue to assume significance in the direction of bond yields," she said.

The RBI's Monetary Policy Committee meeting is scheduled during June 6-8. The monetary policy decisions are scheduled to be announced on June 8.

In the first monetary policy committee meeting of the current financial year held during April 6-8, the RBI had kept key rates unchanged. However, due to the evolving inflation-growth dynamics especially in view of the impact of the Russia-Ukraine conflict, the monetary policy committee held an off-cycle meeting on 2nd and 4th May 2022 in which it decided to hike the policy repo rate by 40 basis points to 4.40 per cent. This was the first increase in the policy repo rate since May 2020.

By the end of the current financial year, the RBI is likely to hike the policy repo rate to 5.65 per cent from the current 4.4 per cent.

In the off-cycle monetary policy review last month, the central bank also hiked Cash Reserve Ratio (CRR) by 50 basis points to 4 per cent. With the 50 basis points hike in CRR, the RBI sucked out Rs 87,000 crore liquidity from the system.

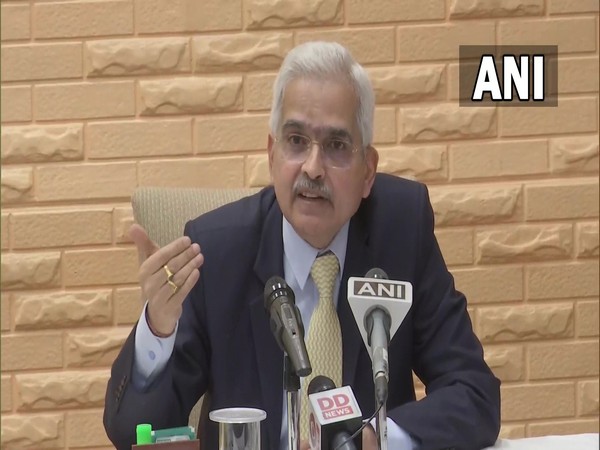

RBI Governor Shaktikanta Das recently categorically said that there would be the policy rate hike in June. Das said in an interview that the expectation of rate hikes in June is a "no-brainer".

"We may have seen the peak of inflation for now but we may not have seen the end of it yet. And failure to bring down inflation even after the central bank reaches the neutral rate has the possibility of destabilising the economy," said Churchil Bhatt, Executive Vice President, Kotak Mahindra Life Insurance Company.

"Failure to contain the inflation genie should scare the markets more than the policymaker's fight against it. We expect the MPC to deliver a no-brainer policy rate hike of 25-40 (basis points) bps in June," Bhatt added.

India's Consumer Price Index (CPI) based inflation surged to an eight-year high of 7.79 per cent in April. The headline inflation is likely to remain above 7 per cent in May as well.

According to foreign brokerage firm Bank of America Securities, the RBI is likely to raise the policy rate by 0.40 per cent next week and by another 0.35 per cent in August.

The RBI may increase the repo rate by another 0.40 per cent next week. Apart from this, in the August review also, it can increase by 0.35 per cent. If this does not happen, then the RBI can make up its mind to increase by 0.50 per cent next week and 0.25 per cent in August, Bank of America Securities said in a report.

The headline inflation has been much above the RBI's target limit of 6 per cent for the past several months. In order to bring the sticky inflation down to its targeted band, the RBI is likely to enforce aggressive monetary policy tightening.

"We, in the RBI, remain steadfast in our commitment to contain inflation and support growth. Inflation must be tamed in order to keep the Indian economy resolute on its course to sustained and inclusive growth," RBI Governor had said in his monetary policy statement on May 4.

On inflation, Bank of America Securities said the retail inflation is likely to come down to 7.1 per cent in May. CPI-based inflation is likely to average 6.8 per cent during the current financial year.

In April, the RBI revised upward the inflation forecast for the current financial year to 5.7 per cent from its earlier projection of 4.5 per cent announced in February.

According to Bank of America Securities, the RBI is likely to further raise its inflation expectation for the current financial year to 6.5 per cent. The RBI is likely to do this upward revision in inflation projection either next week or in August.