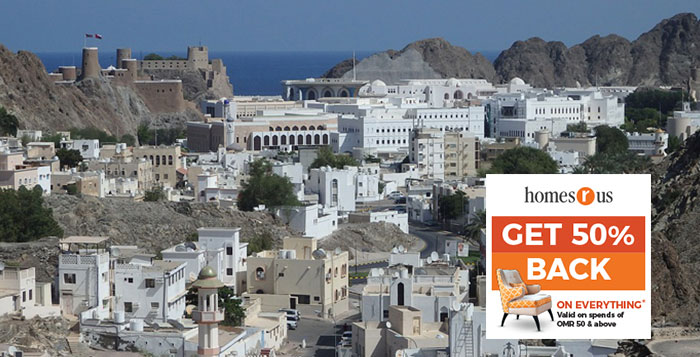

Muscat: Expats who wish to buy apartments in Oman under a new scheme launched by the government can fund their investment with the help of local banks, a senior official at a real estate firm in the country has said.

Fahad Al Ismaily, the CEO of Tibiaan Properties, said expats can pay for flats listed under the usufruct scheme by taking out a bank loan, which can then be repaid in instalments.

“The Ministry of Housing and Urban Planning has expanded and amplified the rule to make it understandable,” he said, speaking to Times TV. “They have issued a document which provides an explanation about the work being done, which is good, because there was a lot of confusion among people in this matter, as well as incorrect information sometimes given by real estate agents.”

“This explanation has helped non-Omanis to obtain finance from banks for this new scheme,” he added. “They can finance their residential units and get the necessary funding from local banks, paying back these loans on instalments.”

The usufruct ownership scheme for real estate in Oman is aligned with the government’s Tawazun, or medium-term financial plan. One of the plan’s articles is about real estate promotion and real estate investments, which aim to diversify the economy, create good foreign investment opportunities.

“The government is looking to share its best practices, and make sure everyone is aware of the scheme,” explained Al Ismaili.

Under the scheme, expatriates can currently buy property in certain areas of Muscat, including designated zones in Boushar, Seeb and Amerat.

“This will be the starting point for the scheme, and it will then be expanded to other governorates,” explained Al Ismaili. “These areas are not primarily residential, but more commercial in nature, where expatriates or non-Omanis may like to stay, as opposed to purely residential areas, where locals have their homes.”

“This rule also looked to maintain the demography of the country, while ensuring every community maintains a healthy way of living, and making sure everyone in the community is able to meet their needs,” he added. “With anything new, we need to test the water before penetrating it aggressively. I second the government’s decision in taking this careful step, because this is a new scheme we are entering.”

According to the regulations concerning the scheme, only flats in buildings that are already built and are less than four years old can be bought. The building must also be at least four storeys high. Furthermore, the flat in question must have at least two bedrooms. Only 40 per cent of flats in any building can be put up under the usufruct scheme, with a maximum of 20 per cent of people from the same nationality allowed to buy property in a single building. Flats must also cost at least OMR35,000. Flats can also be transferred to an owner’s legal heirs.

“You cannot have the same price for all the projects: some may have central cooling, a swimming pool, a park, children’s play areas, central gas pipelines, and many other facilities, but others may not have these amenities, so each developer will know how they need to price their units,” said Al Ismaili.

Should someone wish to sell their flat, they can do so four years after purchase, while they can also remain its owners after they leave the country.