Muscat: Zubair Small Enterprises Centre (Zubair SEC), in partnership with the Omani International Development and Investment Company (Ominvest), has now completed the third in a series of five VAT-focused webinars for SMEs in Oman, titled ‘Key Compliance and Documentation under Value Added Tax (VAT) in Oman’.

In addition to the five webinar sessions, this ‘Know Your VAT’ initiative, executed by Moore, will also include five short, animated videos, a digital downloadable booklet, and one-to-one sessions where required.

Commenting on the ‘Know Your VAT’ initiative, Nauzer Nowroji – Senior Adviser at Zubair SEC said, “The VAT law is still in its infancy here in the Sultanate with many companies, especially local SMEs, unaware of all its intricacies and details. This webinar series has been specially designed to address these issues, offering SMEs a platform to greatly increase their knowledge on the subject on their way to becoming fully VAT-compliant.”

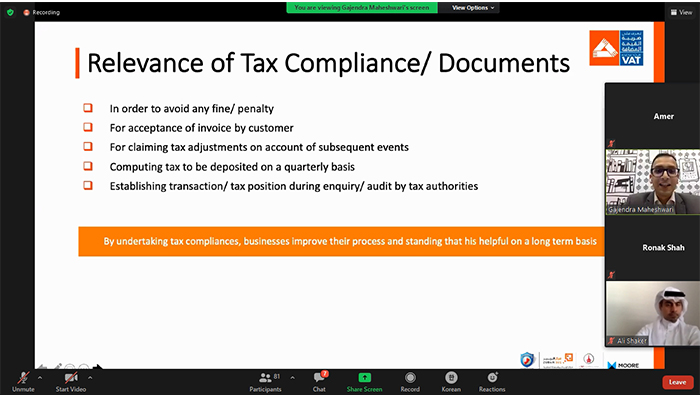

This third webinar, titled ‘Key Compliances and Documentation under Value Added Tax (VAT) in Oman’, was conducted on June 9. It continued from where the last webinar left off, covering three core topics – Tax Invoices, debit notes, and credit notes; Return submission and tax payments; and record keeping. The webinar was attended by over 90 participants from Zubair SEC members as well as some large private-sector corporations. Each of them expressed their appreciation to the organisers, as well as expressed their desire to return for the remaining two webinars.

“Receiving such a great turnout with every new VAT webinar we host is extremely encouraging. It’s a clear sign of local entrepreneurs’ willingness to learn about and embrace the concept of VAT,” said Nauzer Nowroji. “For those who may have missed this, or the previous webinars, can view them on the Zubair SEC website, together with further details of the 'Know Your VAT' initiative. We would also like to invite all interested parties to register for the next webinar by contacting Zubair SEC at the earliest.”

“For any corporate, proper and detailed documentation plays a major role in them becoming fully VAT-compliant. This can, however, be daunting for anyone not familiar with the concept. This third session was carefully developed to ensure this critical component of VAT was easy to understand and replicate. As with our previous two sessions, I was glad to see that nearly all attendees grasped the ideas almost immediately,” added Ankur Jain, Director at Moore.

The next 'Know Your VAT' webinar will be focusing on ‘Key Aspects Related to Input Tax Credit’.

.